What is Preferred Equity?

A basic overview of preferred equity, and how it is used

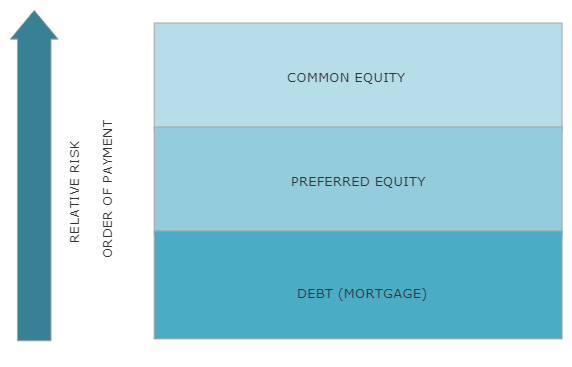

Real estate investments sometimes offer a class of investment called "preferred equity." This means that the preferred equity is paid first, before everyone else, called common equity.

Like Debt and Like Equity

Preferred equity acts like both debt and like equity.

Investors will periodic payments of a fixed amount, like an interest payment on a bond. They also participate - with limitations described below - in the profit made from the investment, like equity investors.

How this Works

During the course of an investment, the investment sponsor determines how much cash should be distributed and at what intervals. The first group in line to be paid is in the best spot because the chances of being paid in full from income from the property are very high. Usually, the bank holding a mortgage on the property takes first place. Then, in an investment with preferred equity, the preferred investors are paid right after the bank. This spot, right after the lender, makes them "preferred" when compared to the common investors. Whatever is left - and it could be a little or a lot - is taken by common equity holders.

Added Bonus: Cumulative

Some preferred equity interests are also cumulative

, which is an added benefit. If a distribution of income is skipped for some unanticipated reason, it will be repaid to the preferred owners in the future. These interests are called " cumulative preferred.

" At the end of the investment, when the investor's original contribution is returned, the investment sponsor ordinarily confirms that each investor reached their stated rate of return and, if not, provides "catch up" before anyone else is paid.

Cap on Return

One of the downsides to preferred equity is that there is a limit total return. So, a preferred equity investment that provides a minimum 10% preferred return also means that the investor's total upside in the investment is capped at 10%. In this case, if the investment's return is greater than the 10%, the preferred investor is left at 10% while the common interest holders make more. The trade for the relative safety of the preferred return is this limit.